Smarter Saving for Real Life

Savings Pools Pro calculates the lowest possible savings rate that guarantees you'll meet all your future goals — without straining your paycheck.

Features

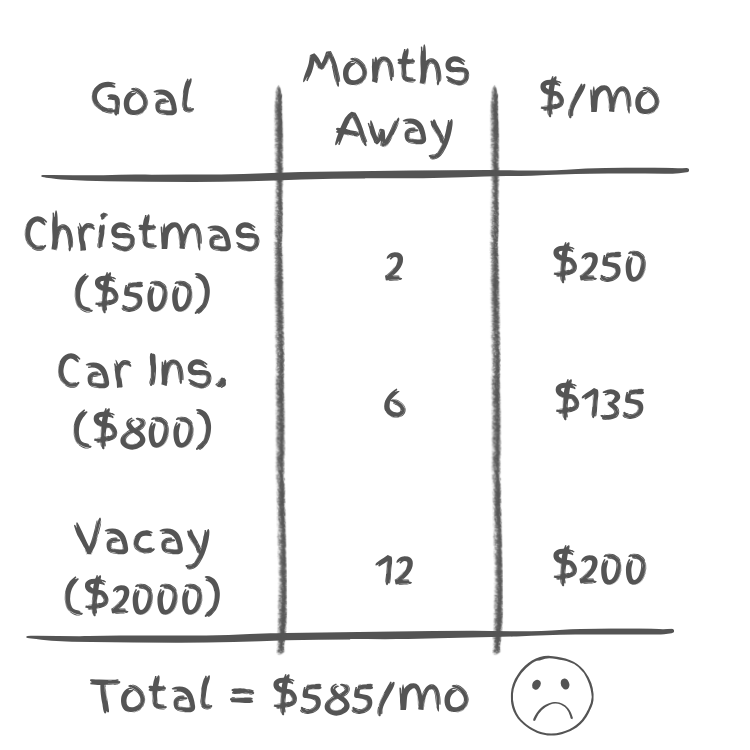

Budgeting for Real Life Is Hard

When you budget for irregular expenses — like car repairs, insurance premiums, sports fees, Amazon Prime, or Christmas gifts — the math seems simple: divide each cost by the number of paychecks until it's due. But that makes early paychecks overloaded. You end up saving too much too soon, and your system collapses before it even starts.

The Sprint Problem

It's like trying to run a marathon by sprinting the first mile — you'll never make it to the finish.

Early Burnout

Your first few paychecks are drained trying to catch up on everything at once.

System Collapse

When you can't keep up, the whole budget falls apart and you're back to square one.

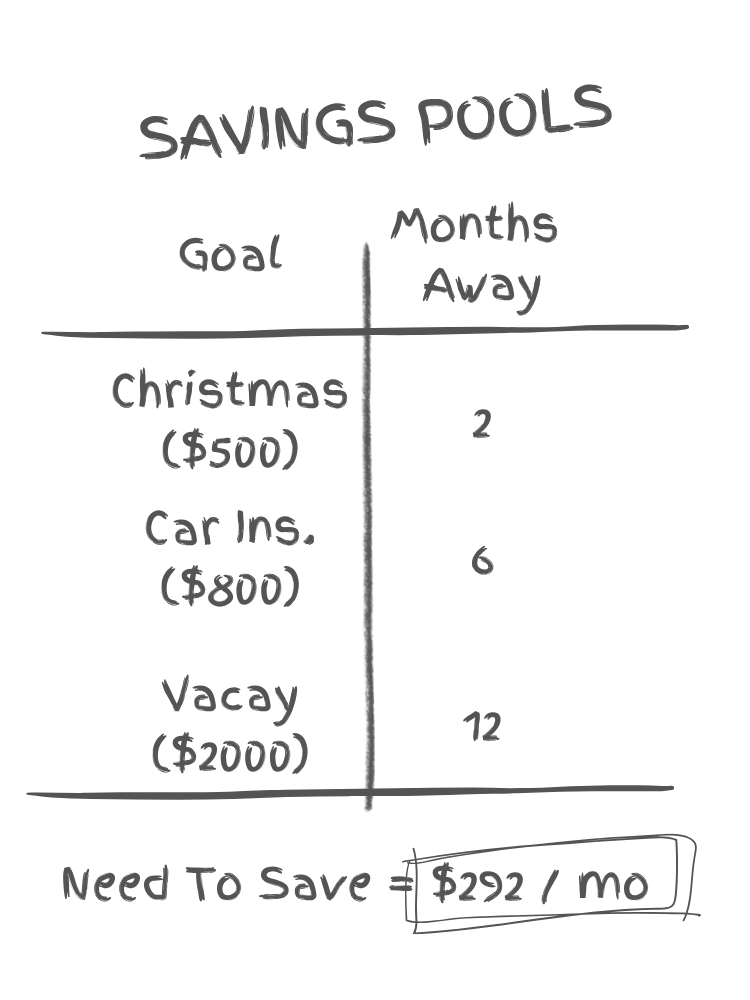

Meet Savings Pools

Savings Pools Pro calculates a single, stable savings rate that covers all your goals on time — and that rate can only ever go down, never up. Each paycheck, you save the exact amount needed to stay perfectly on track. No stress. No spreadsheets. No panic.

Mathematically Optimal

Always the lowest sustainable savings rate.

Never Over-Save

Keeps more cash in your checking account early on.

Predictable & Peaceful

Rate only declines as goals get closer.

Savings Pools Pro Does It For You

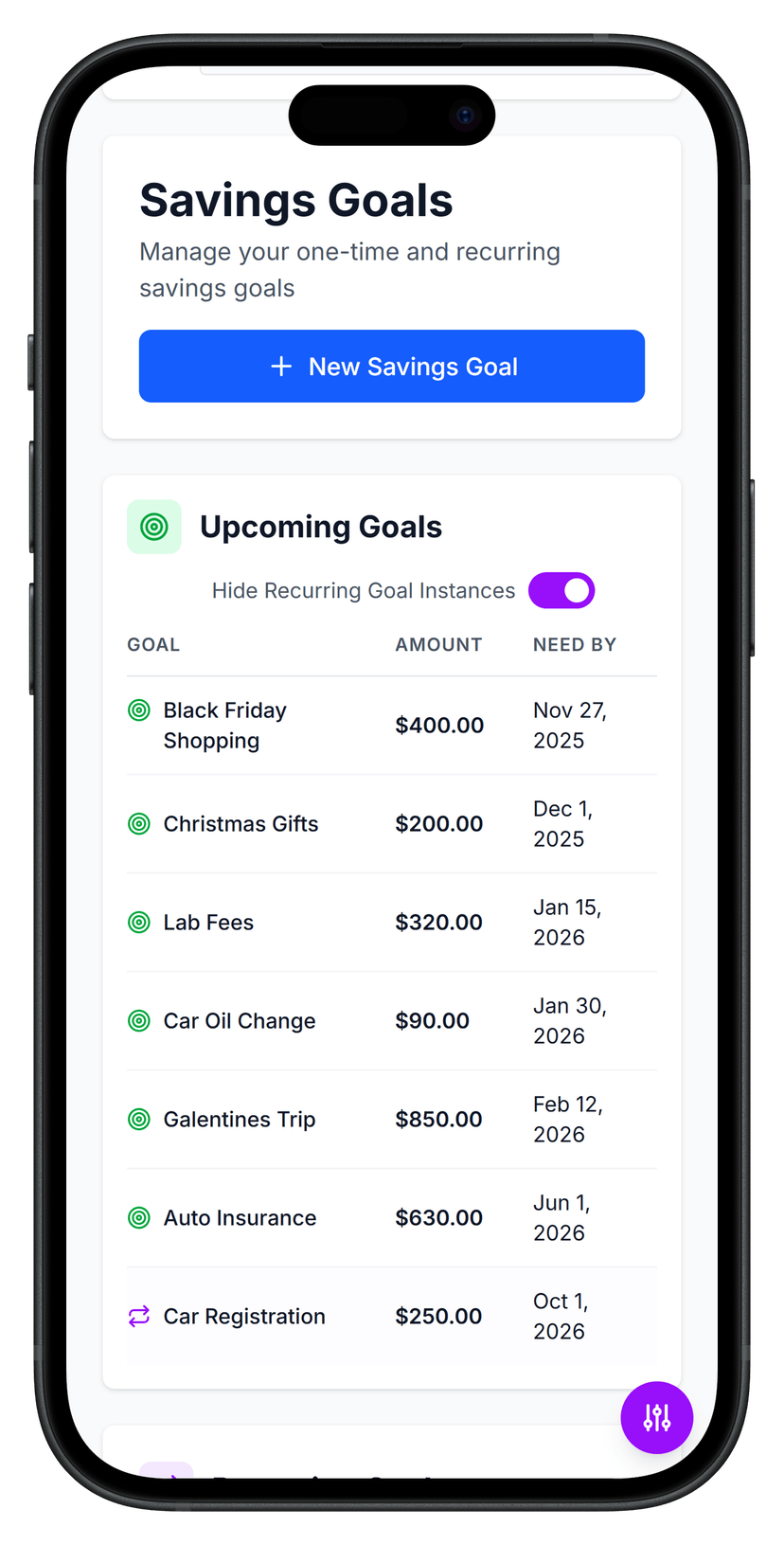

You could calculate these numbers yourself, but our free calculator does the math for you. Easily add, edit, or remove goals over time. It automatically takes into account starting balances, unexpected withdrawals (like when you have to pull money from a Savings Pool for an unplanned emergency), and recalculates your rate instantly.

Free Calculator

See your optimal savings rate instantly — no spreadsheets required.

Flexible & Forgiving

Add new goals or handle emergencies — your rate adjusts automatically.

Pro Automation

Upgrade for hands-free saving with Sequence integration.

How It Works

From chaos to calm — in 3 simple steps.

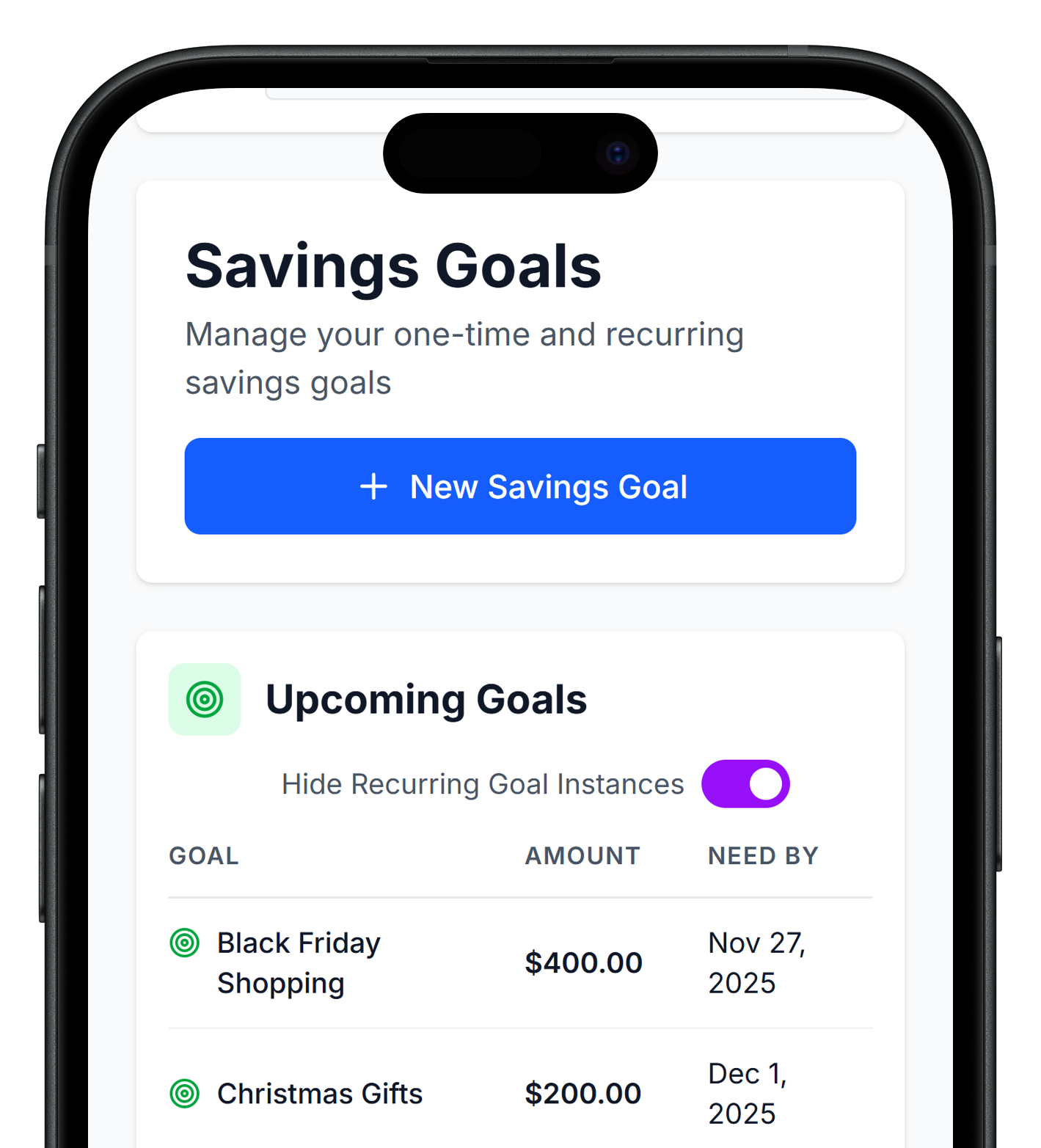

1. Add Your Goals

Tires, insurance, trips, gifts — whatever you're saving for.

2. Set Your Pay Schedule

For example, weekly, biweekly, monthly, ...

3. Get Your Perfect Rate

Save this much each paycheck to hit every goal on time.

Pro Plan Automation

Subscribe to Pro and integrate with Sequence for hands-free savings.

Auto-Funded Savings

Your Savings Pool is automatically funded according to your schedule — no action needed. You'll get an email confirmation each time.

Daily Rate Updates

Your savings rate and account balances are updated daily, so your rate is always exactly right.

Automatic Payouts

Savings goals are fully funded before their need-by date. Money automatically transfers to your spending account in time for you to use it.

Simple, transparent pricing

FEATURES

Try the Calculator

- Calculate your optimal per-paycheck savings rate

- Email reminders to fund your Savings Pool

- Email reminders when Savings Goals can be paid out

- Add, remove, or modify Savings Goals anytime

FEATURES

Hands-off automation via Sequence

- All Free features

- Automatic funding of Savings Pool within Sequence

- Automatic daily balance updates for accurate calculations

- Funds land in your spending account right before expense is due

- Smart scheduling avoids weekends and bank holidays

- Zero spreadsheets or manual transfers

- Email confirmations of all transfers

Save smarter, not harder.

Stop sprinting toward your next expense. Let Savings Pools Pro find your perfect pace.